Establishing a company in NJ can be a wise choice, forming an LLC is a smart step. It offers personal liability protection and can streamline your operations. However, this process involves more than just paperwork. You'll need to take important choices and adhere to state regulations, with each step playing a vital role in your company’s foundation. Prior to starting, it's crucial to know what to expect next.

Selecting a Distinct Name for Your NJ LLC

One of the initial steps in establishing your NJ LLC is choosing a unique and compliant business name. You'll need to verify that your name distinguishes your company from existing entities already registered in the state.

Check availability by using New Jersey’s business name database online. Your chosen designation must include “Limited Liability Company,” “LLC,” or a similar abbreviation.

Refrain from using terms that could be confused with your LLC with state departments or necessitate additional authorization. Ensure the term is not deceptive and doesn't violate trademark laws.

Designating a Official Representative

Each NJ LLC must appoint a registered agent to accept legal documents and official correspondence on the company’s behalf.

Your registered agent can be an individual resident of New Jersey or a company licensed to conduct business in the state. You can’t act as your own LLC’s designated representative unless you possess a street address in NJ and are available during normal business hours.

The agent’s main responsibility is to guarantee your LLC gets critical documents, such as tax notices or lawsuits. Choose someone trustworthy, as missing an important delivery could result in significant legal or financial repercussions for your business.

Filing the Public Records Filing for New Business Entity

After you've chosen your designated agent, it's time to officially form your LLC by filing the Public Records Filing for New Enterprise with the New Jersey Division of Taxation and Corporate read more Registration.

You'll file this filing via the internet or by mail. Include your LLC's name, agent details, principal business address, and business objective.

Verify your details, as mistakes can delay approval. You'll pay the necessary $125 filing fee when you submit your application.

Once approved, the authority will release a Certificate of Formation. Retain this certification—it confirms your LLC’s formation and is essential for establishing financial accounts and carrying out business.

Drafting an Operational Agreement

With your Certificate of Establishment in hand, your subsequent step is to create an operational agreement for your NJ LLC.

While New Jersey doesn’t legally require this document, it's crucial for explicitly defining each partner's entitlements, responsibilities, and ownership stakes.

It will specify how your LLC will be managed, share profits, and make key decisions.

An operating agreement also helps protect your limited liability status and prevents disputes among members.

Even if you're the only proprietor, possession of this document bolsters your business’s legal foundation and can prove invaluable.

All partners should examine and sign the completed, mutually agreed document.

Meeting Ongoing Compliance Requirements

Once your NJ LLC is up and running, you'll need to stay on top of a number of compliance tasks each year.

First, file an Yearly Report with the state every year by your LLC’s incorporation date and pay the required charge.

Keep a designated representative with a current New Jersey address.

Maintain good records, such as meeting notes and financial records.

If you collect sales tax or have employees, file the appropriate state tax returns and official documents.

Don’t forget to inform the authorities if your business address or proprietorship shifts.

Remaining in compliance helps you avoid penalties and safeguards your LLC's standing.

Conclusion

Establishing a limited liability company in New Jersey isn’t complicated with the right knowledge. Choose a unique name, pick a reliable registered agent, and complete the requisite documentation with the state. Don’t skip an operating agreement—it aids in running smoothly. Keep up with yearly filings and compliance obligations to keep your LLC in good standing. By following these steps, your enterprise is positioned for success and legal protection right from the beginning.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Hallie Eisenberg Then & Now!

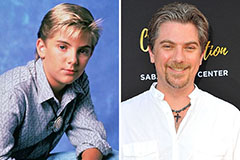

Hallie Eisenberg Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!