If you're considering safeguarding your enterprise and streamlining tax obligations, creating an LLC in Nebraska is a smart move. The steps is not overly complex, but you’ll need to adhere to certain procedures to start correctly. From choosing the right name to staying on top of paperwork, each step is crucial. Let's explore what you need to do first—because getting elements right now can avoid problems down the road.

Choosing a Name for Your Nebraska LLC

Before you can registering your Nebraska LLC, you’ll need to select a business name that’s unique and complies with the state’s rules.

Start by using the Nebraska Secretary of State’s online business name search tool to ensure your desired name is not already taken. Your LLC name must contain “Limited Liability Company,” “L.L.C.,” or “LLC.”

Steer clear of terms that could confuse your business with a government agency, such as “FBI” or “Treasury.” Some restricted words, like “Bank” or “Attorney,” require further steps.

Once you’ve found an available name, think about reserving it to hold your spot.

Choosing Your Nebraska LLC's Registered Agent

When you form an LLC in Nebraska, you will need to designate a registered agent to receive legal documents and important government notices on your company’s behalf.

Your registered agent can be an local Nebraska or a business authorized to do business in the state. They must have a real location (not a P.O. box) in Nebraska and be available during normal business hours.

You can act as your self-employed agent, select a trusted partner, or engage a professional service. Ensure your agent is trustworthy—missed documents or deadlines could cause fines, penalties, or even administrative dissolution.

Officially Registering Your LLC

Once you have chosen your registered agent, the next step is to file the Certificate of Organization with the Nebraska Secretary of State.

You’ll need to gather basic information about your LLC, including its name, designated office address, and your agent’s details.

File the certificate online or by mail, and submit payment for the filing charge.

Review your details for precision—mistakes can delay approval.

After completing the paperwork, the state will evaluate your submission.

If everything’s correct, they’ll register your LLC.

Keep your filed certificate for your records—it’s vital proof that your Nebraska LLC is formally created and recognized.

Drafting Your LLC's Operating Agreement

Many Nebraska LLC owners create an operating agreement to clearly outline how their business will run. There is no legal obligation to have one in Nebraska, but it’s certainly a prudent move.

This private document outlines key elements like ownership, management structure, profit sharing, decision-making rules, and the steps if someone wants to leave the LLC. By setting clear guidelines, you can help prevent disputes among members and protect your limited liability status.

You can customize your agreement to fit your business’s unique needs. how to start an llc in nebraska Having everyone sign it guarantees all members are on the same page and committed to the agreed arrangements.

Meeting State Requirements and Ongoing Compliance

After forming your Nebraska LLC, you will need to pay mind to the state’s regulations to keep your business in proper status.

Each year, it’s necessary to file a biennial report online with the Nebraska Secretary of State and pay the required fee. Verify your registered agent’s information stays current since the state needs a dependable contact.

Maintain proper records, including your operating agreement, meeting notes, and financial statements. Nebraska also anticipates you to stay compliant with state tax obligations and licensing rules that are relevant to your industry.

Conclusion

Establishing an LLC in Nebraska isn’t as complicated as it might appear. By selecting the right name, designating a registered agent, submitting your Certificate of Organization, and drafting an operating agreement, you’re creating a foundation for success. Be sure to stay on top of state requirements and file your biennial reports to keep your LLC in good standing. Follow these steps, and you’ll have a solid foundation for your Nebraska business.

Rider Strong Then & Now!

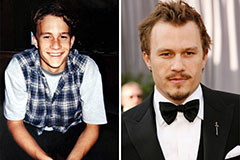

Rider Strong Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!